KEY POINT

- TikTok ranked as the second most downloaded app in the US in 2025 despite near ban threats.

- A new TikTok US joint venture allows continued operations, including e-commerce and advertising.

- China linked apps such as Temu and Shein maintained US growth after trade rule changes.

TikTok will continue operating in the United States under a newly announced joint venture, easing years of uncertainty over a potential ban, even as the short video platform recorded one of its strongest years of growth in 2025 amid heightened national security scrutiny, trade restrictions and political pressure.

The creation of a TikTok US joint venture marks a pivotal moment for one of the world’s most influential social media platforms.

While US lawmakers and regulators intensified scrutiny over the app’s Chinese ownership, TikTok continued to expand its user base and revenue, underscoring its resilience in a politically charged environment.

The deal provides operational continuity for millions of American users and businesses that rely on the platform for marketing, commerce and digital engagement.

TikTok, owned by Beijing-based ByteDance, has faced mounting pressure in Washington over concerns that the Chinese government could access US user data or influence public discourse.

Those concerns culminated in a law signed by President Joe Biden in April 2024 requiring ByteDance to divest TikTok’s US operations or face removal from American app stores.

In January 2025, the US Supreme Court upheld the law, effectively setting the stage for a ban.

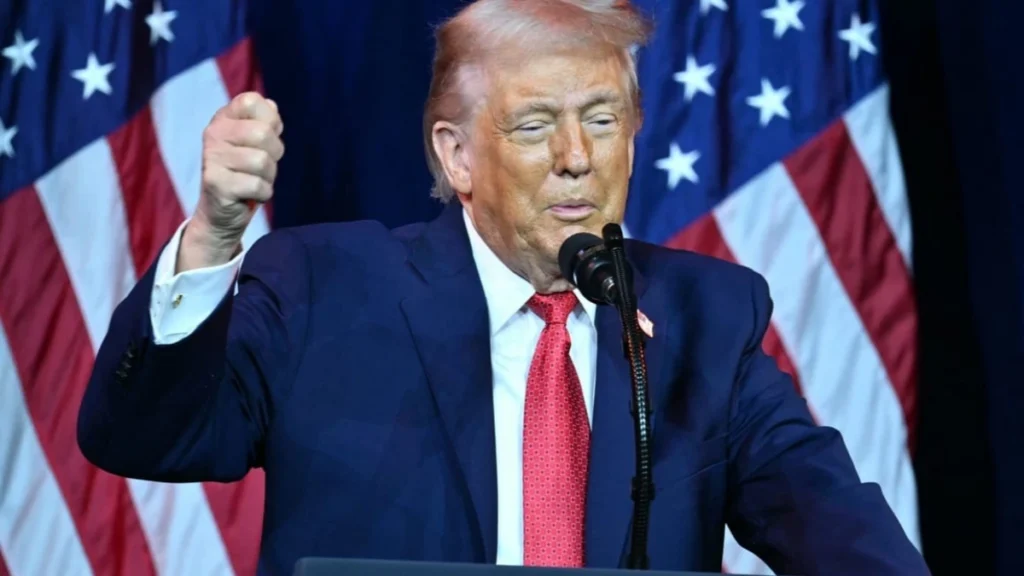

TikTok briefly went offline that month, but enforcement was delayed after President Donald Trump, upon returning to office, repeatedly extended the deadline while negotiations continued with potential US investors.Despite the uncertainty, TikTok remained a dominant force.

According to Sensor Tower, the app ranked second among the most downloaded applications across Apple’s App Store and Google Play in the United States in 2025.

ByteDance’s CapCut video editing app ranked fourth, highlighting the continued popularity of China originated consumer technology in the US market.

The TikTok US joint venture reflects a broader pattern of adaptation by Chinese linked technology firms facing geopolitical headwinds.

Liang Chen, a professor of strategy and entrepreneurship at Singapore Management University, said the performance of these apps in 2025 demonstrated operational maturity rather than short-term regulatory maneuvering.“These platforms are not simply exploiting policy gaps,” Chen said.

“They have developed adaptive ecosystems that can respond to regulatory, consumer and supply chain pressures simultaneously.”

The app’s success also illustrates the limits of political pressure when confronted with strong consumer demand.

Sensor Tower data showed that US users continued to favor TikTok for its recommendation algorithms and integrated commerce features, even as alternatives such as Xiaohongshu, known as RedNote in English, attracted increased attention during the ban debate.

| Metric | 2024 | 2025 |

|---|---|---|

| TikTok US revenue growth | 25.7% | 26.2% |

| TikTok US revenue | $11 billion (approx.) | $13.9 billion |

| US app download rank | No. 1–2 range | No. 2 |

Source: Coresight Research, Sensor Tower

Retail consulting firm Coresight reported that TikTok’s US revenues, including advertising, in app purchases and e-commerce, rose to $13.9 billion in 2025. Growth was driven largely by TikTok Shop, which allows users to buy products directly through videos and livestreams.

Xiaomeng Lu, director of geo-technology at Eurasia Group, said TikTok’s 2025 performance highlighted a rare case in which commercial strategy outweighed geopolitical tension.

“The company demonstrated a path for navigating US China friction without exiting a critical market,” Lu said. “That is unusual in the current climate.”

TikTok said its US entities under the new joint venture will continue managing e-commerce and advertising operations, providing stability for creators and small businesses that depend on the platform for income.

Meanwhile, competitors in social commerce also showed resilience. Temu ranked seventh among US app downloads in 2025 despite new tariffs imposed by the Trump administration, while Shein became the most downloaded apparel shopping app in the country, according to Sensor Tower.

A senior US trade official, speaking on background due to ongoing negotiations, said the closure of the “de minimis” loophole on May 2 forced companies to adjust logistics and pricing strategies but did not eliminate consumer demand for low-cost online retail.

While the TikTok US joint venture reduces the immediate risk of a ban, regulatory oversight is expected to continue.

The deal must still satisfy national security reviews and comply with evolving data governance requirements.

Broader US China relations, including trade policy and technology controls, will remain a key factor shaping the platform’s long-term operations.

Temu and Shein also face ongoing scrutiny related to tariffs, labor practices and product safety standards.

Both companies have moved headquarters outside China, though much of their supply chain remains there, leaving them exposed to future trade actions.

TikTok’s ability to secure a US joint venture while posting strong growth in 2025 underscores the platform’s entrenched role in the American digital economy. As policymakers continue to weigh national security concerns

Q 1: What is the TikTok U.S. joint venture?

Answer: It is a new business setup allowing TikTok to operate in the U.S. without facing a ban.

Q 2: Is TikTok banned in the U.S.?

Answer: No, TikTok remains active in the U.S. following the joint venture agreement.

Q 3: How will the TikTok U.S. joint venture affect users?

Answer: Users can continue using the app normally, including TikTok Shop and advertising features.